S&P 500 Technical Analysis 2025-07-25 09:20:56

Daily Technical Analysis – S&P 500

Date: 25.07.2025

Time: 09:20:22

Daily Chart Overview

- Trend: The daily chart shows an upward trend, slightly tapering off, indicating potential consolidation.

- Volume: The average daily volume suggests stability but might lack enough momentum for a strong breakout.

- Indicators:

- Bollinger Bands suggest the price is near the upper band, implying overbought conditions.

- MACD is slightly positive, indicating a weakening bullish momentum.

- Stochastic RSI is above 70, indicating overbought conditions.

- RSI is around 73, supporting overbought conditions.

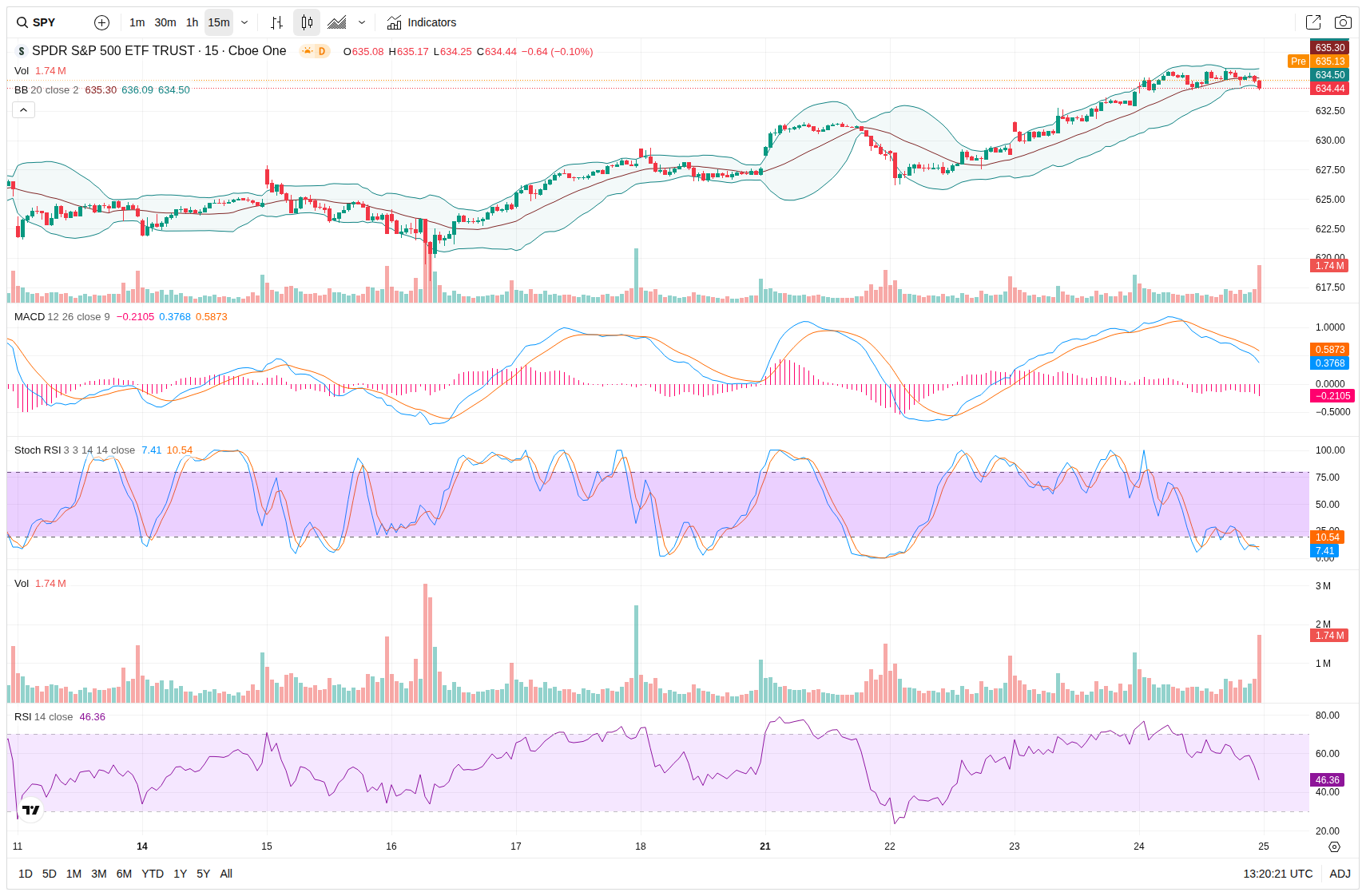

15-Minute Chart Overview

- Trend: The 15-minute chart indicates a short-term downtrend, with slight corrections.

- Volume: A spike in volume has been observed in recent sessions, suggesting upcoming volatility.

- Indicators:

- Bollinger Bands show prices at the lower band, suggesting oversold conditions.

- MACD is negative and below the signal line, confirming bearish momentum.

- Stochastic RSI is around 10, indicating oversold conditions.

- RSI is at 46, suggesting the potential for reversal.

Market Momentum and Prediction

- The market exhibits mixed signals with a short-term bearish and medium-term bullish trend.

- Short-term corrections may continue, but the daily trend suggests possible recovery.

End-of-Day Projection

- With 6.66 hours left in the trading day, expect potential recovery towards the upper Bollinger Band.

- Volatility may increase, as depicted by volume fluctuations and oversold conditions on the 15-minute chart.

- The expected end-of-day closing range is likely between the current price and the upper Bollinger Band limit.